- Visa crypto

- When will the crypto bull run end

- Crypto com nft

- Cryptocurrency prices

- Best crypto to buy

- Cryptocurrency exchanges

- Doge token vs dogecoin

- How does bitcoin make money

- How much to buy dogecoin

- How much is 1eth

- Polygon crypto

- Cryptocom verification process

- To invest all profits in crypto

- Squid currency

- Etherlite coin price today

- Bitcoin price in 10 years

- Buy baby dogecoin

- Top 20 cryptocurrency

- Free btc mining

- Crypto market live

- Crypto com earn

- Cryptocom dogecoin

- Where to buy crypto

- Bitcoin starting price

- Btc mining

- Cryptocurrency to buy

- Cryptos

- Buy elon crypto

- When could you first buy bitcoin

- Centralized crypto exchanges trading volume year

- How do you buy cryptocurrency

- How to use crypto

- Cryptocom coins available

- Google bitcoin

- Crypto help

- Popular cryptocurrency

- Who has the most btc

- Why is bitcoin valuable

- Cryptocurrency bitcoin price

- How many btc are there

- Ethusd converter

- Metaverse crypto

- How much is bitcoin

- Bitcoin apps

- Cours crypto

- What is gyen crypto

- Buy physical bitcoin

- Time wonderland crypto

- Crypto number

- Bitcoin cryptocurrency

- New crypto coins

- How to fund crypto com account

- How much is pi crypto worth

- Btc gbp

- When to sell crypto

- Cosmos crypto

- How to add bank account to cryptocom

- Crypto dogecoin

- 1 btc in usd

- Cryptocom shiba inu

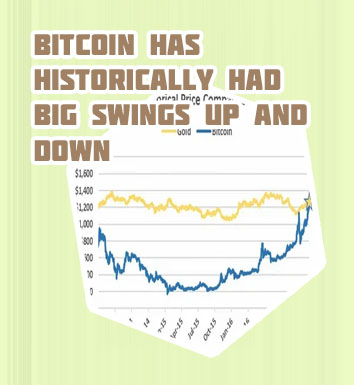

Bitcoin price comparison

When it comes to comparing Bitcoin prices, it is essential to stay informed about the latest trends and developments in the cryptocurrency market. To help you make well-informed decisions, we have compiled a list of two articles that provide valuable insights into Bitcoin price comparison.

Are you looking to compare Bitcoin prices across different platforms or exchanges? Understanding the variations in Bitcoin prices can help you make informed decisions when buying or selling this popular cryptocurrency. To assist you in your research, we have curated a list of 4 articles that delve into Bitcoin price comparisons. These articles will provide you with valuable insights and strategies for navigating the dynamic world of Bitcoin pricing.

Analyzing Bitcoin Price Differences Between Exchanges

Bitcoin price differences between exchanges have become a common phenomenon in the world of cryptocurrency trading. These differences can be attributed to various factors such as liquidity, regulatory issues, and market manipulation. Understanding and analyzing these price differences can provide valuable insights for traders looking to capitalize on arbitrage opportunities.

One practical use case of analyzing Bitcoin price differences between exchanges is to exploit these price differentials to generate profits. By buying Bitcoin at a lower price on one exchange and selling it at a higher price on another, traders can take advantage of the price inefficiencies in the market to make a profit. This arbitrage strategy requires quick execution and careful monitoring of price movements across different exchanges to ensure profitability.

Additionally, analyzing Bitcoin price differences between exchanges can also help in identifying trends and patterns in the market. By comparing price movements on various exchanges, traders can gain a better understanding of market dynamics and make more informed trading decisions. This can lead to improved trading strategies and better risk management, ultimately resulting in positive outcomes for traders.

In conclusion, analyzing Bitcoin price differences between exchanges is a valuable practice for traders looking to optimize their trading strategies and maximize profits in the volatile cryptocurrency market. By staying informed and vigilant, traders can take advantage of price discrepancies to achieve positive results and enhance their overall trading experience.

Tips for Comparing Bitcoin Prices on Different Platforms

Today, we have the pleasure of sitting down with an expert in the field of cryptocurrency to discuss the importance of comparing Bitcoin prices on different platforms. Let's hear what they have to say.

Interviewer: Can you tell us why it is essential to compare Bitcoin prices on various platforms?

Expert: Absolutely. Comparing Bitcoin prices on different platforms is crucial for making informed investment decisions. Prices can vary significantly between exchanges due to factors such as liquidity, supply and demand, and trading volume. By comparing prices, investors can ensure that they are getting the best possible deal when buying or selling Bitcoin.

Interviewer: What are some tips you would give to individuals looking to compare Bitcoin prices effectively?

Expert: One tip is to use price comparison websites or apps that aggregate prices from multiple exchanges. These tools can help investors quickly identify the best prices available. Additionally, it's essential to consider factors such as fees, security, and reputation when choosing a platform to trade Bitcoin on.

Interviewer: How can comparing Bitcoin prices on different platforms benefit investors?

Expert: By comparing prices, investors can potentially save money on their trades and maximize their profits. Additionally, comparing prices can help investors identify arbitrage opportunities, where they can buy Bitcoin on one platform at a lower price and sell it on another platform

The Impact of Market Trends on Bitcoin Price Discrepancies

The price of Bitcoin is inherently volatile, making it susceptible to market trends and fluctuations. Understanding the impact of market trends on Bitcoin price discrepancies is crucial for investors looking to capitalize on opportunities in the cryptocurrency market.

-

Market Sentiment: Market sentiment plays a significant role in influencing Bitcoin prices. Positive news, such as regulatory approvals or institutional adoption, can drive up demand and push prices higher. Conversely, negative news, such as security breaches or regulatory crackdowns, can lead to a drop in prices.

-

Speculation: Speculation also plays a key role in Bitcoin price movements. Traders and investors often buy or sell Bitcoin based on speculation about future price movements. This speculative behavior can create price discrepancies and lead to market inefficiencies.

-

Supply and Demand: Like any other asset, the price of Bitcoin is determined by the basic economic forces of supply and demand. When demand for Bitcoin exceeds its available supply, prices tend to rise. Conversely, when supply outstrips demand, prices tend to fall.

-

Market Manipulation: The unregulated nature of the cryptocurrency market makes it susceptible to market manipulation. Whales, or large holders of Bitcoin, can influence prices by buying or selling large amounts of the cryptocurrency. This can create artificial price discrepancies and distort market

How to Utilize Price Comparison Tools for Bitcoin Investments

Price comparison tools are essential for savvy investors looking to optimize their Bitcoin investments. These tools allow users to compare prices across various exchanges, helping them make informed decisions about when to buy or sell. By utilizing price comparison tools, investors can take advantage of price discrepancies between exchanges, potentially increasing their profits.

One of the key benefits of using price comparison tools is the ability to quickly identify the best prices for buying or selling Bitcoin. This can help investors save time and money by ensuring they are getting the best deal possible. Additionally, price comparison tools can provide valuable insights into market trends, helping investors make more informed decisions about their investments.

Another advantage of price comparison tools is the ability to track price movements in real-time. This can be especially useful for day traders who need to make quick decisions based on market conditions. By using price comparison tools, investors can stay ahead of the curve and capitalize on opportunities as they arise.

In conclusion, price comparison tools are invaluable for investors looking to maximize their Bitcoin investments. By leveraging these tools, investors can save time, money, and make more informed decisions about when to buy or sell Bitcoin. In a volatile and fast-paced market like Bitcoin, having access to accurate and up-to-date pricing information is essential for success.