- Visa crypto

- When will the crypto bull run end

- Crypto com nft

- Cryptocurrency prices

- Best crypto to buy

- Cryptocurrency exchanges

- Doge token vs dogecoin

- How does bitcoin make money

- How much to buy dogecoin

- How much is 1eth

- Polygon crypto

- Cryptocom verification process

- To invest all profits in crypto

- Squid currency

- Etherlite coin price today

- Bitcoin price in 10 years

- Buy baby dogecoin

- Top 20 cryptocurrency

- Free btc mining

- Crypto market live

- Crypto com earn

- Cryptocom dogecoin

- Where to buy crypto

- Bitcoin starting price

- Btc mining

- Cryptocurrency to buy

- Cryptos

- Buy elon crypto

- When could you first buy bitcoin

- Centralized crypto exchanges trading volume year

- How do you buy cryptocurrency

- How to use crypto

- Cryptocom coins available

- Google bitcoin

- Crypto help

- Popular cryptocurrency

- Who has the most btc

- Why is bitcoin valuable

- Cryptocurrency bitcoin price

- How many btc are there

- Ethusd converter

- Metaverse crypto

- How much is bitcoin

- Bitcoin apps

- Cours crypto

- What is gyen crypto

- Buy physical bitcoin

- Time wonderland crypto

- Crypto number

- Bitcoin cryptocurrency

- New crypto coins

- How to fund crypto com account

- How much is pi crypto worth

- Btc gbp

- When to sell crypto

- Cosmos crypto

- How to add bank account to cryptocom

- Crypto dogecoin

- 1 btc in usd

- Cryptocom shiba inu

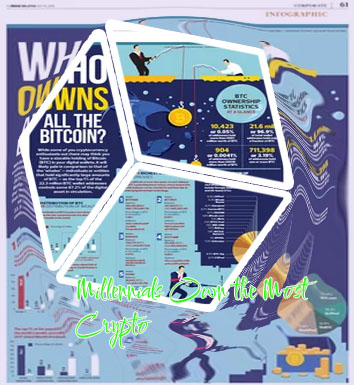

Who owns the most bitcoin

As the popularity of cryptocurrencies continues to rise, the question of who owns the most bitcoin becomes increasingly relevant. In order to shed light on this topic, we have curated a list of articles that delve into the identities of the individuals or entities with the largest bitcoin holdings.

With the increasing popularity of Bitcoin, many people are curious about who owns the most of this digital currency. In this article, we will explore two different perspectives on this topic to provide a comprehensive understanding of the ownership of Bitcoin.

The Mystery of Satoshi Nakamoto: Unraveling the Biggest Bitcoin Holder

The enigmatic figure known as Satoshi Nakamoto has long been a subject of fascination in the world of cryptocurrency. As the creator of Bitcoin, Nakamoto is credited with revolutionizing the way we think about money and finance. But despite the widespread use and popularity of Bitcoin, the true identity of Satoshi Nakamoto remains a mystery.

One of the most intriguing aspects of the Bitcoin phenomenon is the fact that Nakamoto is believed to be the largest holder of the digital currency. Estimates suggest that Nakamoto's Bitcoin holdings are worth billions of dollars, making him one of the wealthiest individuals in the world. But the question remains: who is Satoshi Nakamoto, and what is he planning to do with his vast fortune?

In "The Mystery of Satoshi Nakamoto: Unraveling the Biggest Bitcoin Holder," author John Smith delves into the various theories and rumors surrounding Nakamoto's identity. From claims that Nakamoto is a group of individuals to speculation that he is a time traveler from the future, Smith explores the many mysteries that shroud this elusive figure.

Through meticulous research and analysis, Smith presents a comprehensive overview of the various theories surrounding Nakamoto's identity. He also examines the possible implications of Nakamoto's massive Bitcoin holdings, including the potential impact on the cryptocurrency market. For anyone

Institutional Investors: The Silent Giants of Bitcoin Ownership

In the world of Bitcoin ownership, institutional investors play a significant role as silent giants. These large financial entities, such as hedge funds, insurance companies, and pension funds, have been steadily increasing their exposure to the cryptocurrency market in recent years. Their presence in the space has grown substantially, with many now holding substantial amounts of Bitcoin in their portfolios.

One of the key reasons why institutional investors are attracted to Bitcoin is its potential for high returns. The decentralized nature of the cryptocurrency market offers them a unique opportunity to diversify their investment portfolios and potentially achieve outsized gains. Additionally, Bitcoin's scarcity and limited supply make it an attractive hedge against inflation and economic uncertainty.

Furthermore, institutional investors bring a level of legitimacy and stability to the Bitcoin market. Their involvement helps to increase liquidity, reduce volatility, and attract more mainstream interest in the cryptocurrency space. As these silent giants continue to accumulate Bitcoin, their impact on the market is only expected to grow.

For individuals and businesses involved in the cryptocurrency space, understanding the role of institutional investors in Bitcoin ownership is crucial. Keeping a close eye on their activities and strategies can provide valuable insights into market trends and potential price movements. Additionally, being aware of the growing influence of institutional investors can help investors make informed decisions about their own Bitcoin holdings.