- Visa crypto

- When will the crypto bull run end

- Crypto com nft

- Cryptocurrency prices

- Best crypto to buy

- Cryptocurrency exchanges

- Doge token vs dogecoin

- How does bitcoin make money

- How much to buy dogecoin

- How much is 1eth

- Polygon crypto

- Cryptocom verification process

- To invest all profits in crypto

- Squid currency

- Etherlite coin price today

- Bitcoin price in 10 years

- Buy baby dogecoin

- Top 20 cryptocurrency

- Free btc mining

- Crypto market live

- Crypto com earn

- Cryptocom dogecoin

- Where to buy crypto

- Bitcoin starting price

- Btc mining

- Cryptocurrency to buy

- Cryptos

- Buy elon crypto

- When could you first buy bitcoin

- Centralized crypto exchanges trading volume year

- How do you buy cryptocurrency

- How to use crypto

- Cryptocom coins available

- Google bitcoin

- Crypto help

- Popular cryptocurrency

- Who has the most btc

- Why is bitcoin valuable

- Cryptocurrency bitcoin price

- How many btc are there

- Ethusd converter

- Metaverse crypto

- How much is bitcoin

- Bitcoin apps

- Cours crypto

- What is gyen crypto

- Buy physical bitcoin

- Time wonderland crypto

- Crypto number

- Bitcoin cryptocurrency

- New crypto coins

- How to fund crypto com account

- How much is pi crypto worth

- Btc gbp

- When to sell crypto

- Cosmos crypto

- How to add bank account to cryptocom

- Crypto dogecoin

- 1 btc in usd

- Cryptocom shiba inu

How many bitcoins are in circulation

Bitcoin Circulation: Understanding the Supply of Bitcoins in the Market

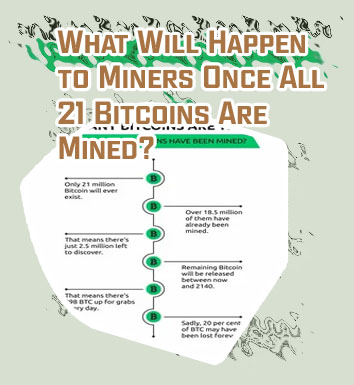

Bitcoin, the world's most well-known cryptocurrency, has a limited supply of 21 million coins. Understanding how many bitcoins are currently in circulation is essential for investors, traders, and anyone interested in the cryptocurrency market. To shed light on this topic, here are three articles that delve into the current circulation of bitcoins and provide valuable insights into this digital currency.

Exploring the Circulating Supply of Bitcoins: What You Need to Know

Cryptocurrency enthusiasts around the world are constantly keeping an eye on the circulating supply of Bitcoins. This key metric provides valuable insights into the market dynamics and the overall health of the Bitcoin ecosystem. Understanding the circulating supply is crucial for making informed investment decisions and staying ahead of the curve in the fast-paced world of digital assets.

The circulating supply of Bitcoins refers to the total number of coins that are in circulation at any given time. This figure excludes coins that have been lost or are otherwise inaccessible, providing a more accurate picture of the available supply. By tracking the circulating supply, investors can gauge the level of demand for Bitcoin and its potential for future growth.

It is important to note that the circulating supply of Bitcoins is limited to 21 million coins, a cap set by the cryptocurrency's creator, Satoshi Nakamoto. This scarcity is a key driver of Bitcoin's value and has contributed to its status as a digital gold standard.

As a resident of World, John Smith from London, UK, shares his feedback on the topic, stating that "Understanding the circulating supply of Bitcoins is essential for anyone looking to invest in this exciting asset class. By staying informed about the available supply, investors can make more informed decisions and navigate the volatile cryptocurrency market with confidence."

Analyzing the Distribution of Bitcoins in Circulation

Bitcoin, the world's first decentralized digital currency, has been gaining popularity and adoption since its inception in 2009. As the number of Bitcoin users continues to grow, it is important to analyze the distribution of Bitcoins in circulation to better understand how this cryptocurrency is being used and held.

One key aspect of analyzing the distribution of Bitcoins is looking at the concentration of wealth among Bitcoin holders. Studies have shown that a small percentage of Bitcoin addresses hold the majority of Bitcoins in circulation. This concentration of wealth raises concerns about centralization and the potential for market manipulation by a few large holders.

Another important factor to consider when analyzing the distribution of Bitcoins is the geographical distribution of Bitcoin users. While Bitcoin is a global currency, certain regions have higher adoption rates than others. Understanding where Bitcoin is most popular can provide valuable insights into the factors driving its adoption and use.

Overall, analyzing the distribution of Bitcoins in circulation is crucial for policymakers, investors, and anyone interested in the future of digital currencies. By gaining a better understanding of how Bitcoins are distributed, we can make more informed decisions about the impact of Bitcoin on the global economy and society.

This topic is important and necessary for anyone involved in the cryptocurrency space, including regulators, investors, researchers, and policymakers. Understanding the distribution of Bitcoins can help

Factors Influencing the Total Number of Bitcoins in Circulation

The total number of Bitcoins in circulation is influenced by a variety of factors that contribute to the complex and dynamic nature of the cryptocurrency market. One of the key factors that determines the total number of Bitcoins in circulation is the rate of mining. Bitcoin mining is the process by which new Bitcoins are created and added to the circulating supply. The rate of mining is controlled by the Bitcoin network's protocol, which adjusts the difficulty of mining based on the total computing power of the network. This means that as more miners join the network and dedicate more computing power to mining, the rate of Bitcoin creation increases.

Another factor that influences the total number of Bitcoins in circulation is the rate of Bitcoin adoption. As more individuals and businesses begin to use Bitcoin for transactions and investments, the demand for Bitcoin increases, leading to a higher price and potentially a decrease in the circulating supply as more Bitcoin holders choose to hold onto their coins rather than sell them.

In addition to mining and adoption, external factors such as regulatory developments, technological advancements, and market sentiment can also impact the total number of Bitcoins in circulation. For example, regulatory crackdowns on Bitcoin mining operations in certain countries can lead to a decrease in the rate of mining and ultimately the total number of Bitcoins in circulation.